RISE Evolution

I’m writing this directly to the RISE community. We’d be nothing without the support you have all given us, and today we’re sharing some exciting news on the direction we’re taking RISE. Consider this part 1 of us revealing what we’ve been cooking behind the scenes.

But first, some background.

Outside of mining, my first serious venture in crypto was building arbitrage strategies on Bitfinex and Binance, first back in 2017. Later I fell down the DeFi rabbit hole, and built RoboVault with @DegenRobot, but we had to wrap it up because the infrastructure just couldn’t support an actively managed fully onchain strategy.

So I had spent time in CEX-world where tech is fast, and as an app builder in DeFi, ultimately wrapping up a project that was truly my baby, because the infrastructure was poor. That frustration ultimate lead to RISE

We set out to bridge the gap between the modern web and crypto. Specifically, we set the goal of building infrastructure that could run CEX-grade orderbooks fully onchain, cohabitating with DeFi. The thesis back then was TradFi and CeFi runs on orderbooks, and unless we can offer the same or better trading infrastructure, onchain trading would never wield a moderate marketshare of global trade. As for taking the more difficult route and building it in the EVM - I made my start in crypto in the depths of money legos, I know first hand how powerful a shared state is. Think how many products exist because of Uniswap, I anticipate a similar impact once onchain orderbooks are finally viable.

Today

Fast forward to today. We’ve built the infrastructure we set out to build - the fastest EVM chain, secured by Ethereum. It’s live in testnet today.

- 3ms execution latency

- 100k TPS

We’ve spent the past 6 months maturing the tech and infrastructure, and it’s very close to production.

The Catalysts

Today we’re sharing the new direction of the RISE ecosystem. I’d like to share some catalysts that have informed this direction.

Every great chain starts with one great app

Solana, Arbitrum and HyperEVM are two great examples of this, Pump, GMX and HL respectively ignited these ecosystems. They are the economic powerhouses that bring opportunities to all other builders on that chain.

An orderbook exchange is that great app for RISE. RISE is uniquely positioned as the first EVM chain to make CEX-quality orderbooks viable on the EVM, sharing state with surrounding DeFi.

Specialise or Die

We’re of the opinion that the days are numbered for the opportunity to launch a successful universal chain, if not already expired. The space has simply grown too much and there is too much for a single team to cover and grow on tech or community innovation alone. This is why L2’s are amazing. They give founders and businesses the opportunity to focus their efforts on the vertical, distribution or individual product they are deeply passionate about and plan to obsess over. For RISE, that’s DeFi. Orderbook DeFi. I would back depth over breadth.

Fast-chain economics are broken

Fast chains have a business model dilemma:

- Users want: Abundant, cheap blockspace

- Chain wants: Blockspace scarcity to generate more fees

The needs of the users are incompatible with the needs of the chain to sustain. This is particularly true for L2s. The top L2s make a majority of their revenue during periods of congestion. A business model innovation is required to solve this problem. We can fix this. Users shouldn’t be paying for gas.

The opportunity for Distribution and Modality Innovation

In crypto we get tunnel-vision on tech being the only avenue for innovation, but business empires have been built on distribution and UX innovations. We’re seeing early signs on this with apps like BasedApp, a non-custodial perps app, that generated over $800k in 1-day revenue without needing to deploy a single smart contract.

Token Listings will go to Permissionless Orderbooks

A spot listing and, increasingly more so, perps listing on top centralised exchanges is extremely desirable for new projects. But I think a majority of crypto participants will agree, there’s something fundamentally broken with the token listings today. The environment today is extremely predatory and desperately needs more transparency. Systems this unbalanced cannot sustain themselves long term and blockchains are the obvious solution to this. Our thesis: onchain spot and perps orderbooks are the missing key here.

Why use DeFi chains? Speculation and Yield

Speculation and Yield are the two reasons users use DeFi chains. DEXs are an incredibly powerful product because they not only offer a great avenue for exposure to assets of your choice, but if done well, they can also generate sustainable deep yield through Market Making Vaults and Delta Neutral strategies (eg, Basis-trade).

The RISE Ecosystem Vision

And with that, today we’re announcing the RISE Ecosystem Vision

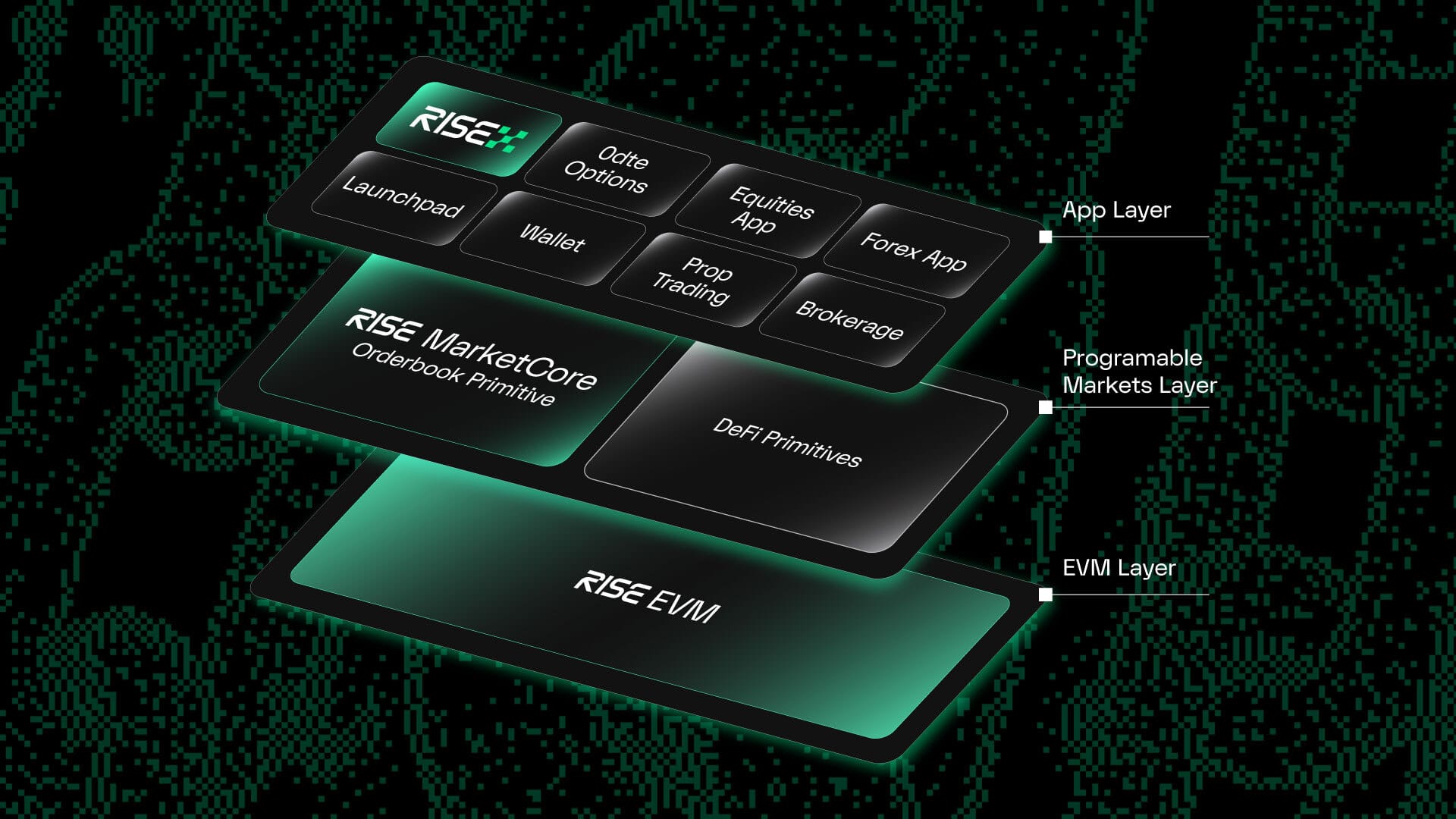

There are three distinct layers in the RISE ecosystem. The App Layer, the Programmable Markets Layer and the EVM Layer.

The EVM Layer

This is what the community knows well. To date, we have:

- Rebuilt the EVM block building pipeline for continuous execution

- Built Shreds - offering 3ms transaction latency

- Extended the EVM RPC to support realtime transactions (eip-7966), now live in Viem, Geth, Alchemy and more

- Built realtime VRF

- Optimised the EVM RPC to support a 100k TPS, 3ms latency chain.

- Processed nearly 4Billion transactions from 4Million EOAs in Testnet

Noteworthy mention: A crowd favourite - famously demonstrated a performance comparason with Chain Derby

The Programmable Markets Layer

The Programmable Markets layer is the DeFi infrastructure that’s needed to support the next generation of Fintech apps. Two core components: MarketCore and DeFi Primitives

MarketCore

Building an orderbook exchange is hard, building it onchain is kind of insane. You need to build a matching engine for perps in Solidity, a risk engine and a CEX-like API, then somehow abstract gas entirely while also subsidising it. Users can always interact directly with the EVM RPC to trade, but a polished API and auth are what the market expects today. On top of that, you have to build out the liquidity on the exchange either yourself or by onboarding quality market makers.

We’ve built exactly this, and we intend on making it available to builders. Mobile app builders can plug into liquid books, founders can list their tokens permissionlessly, and asset issuers can launch their own markets or entire exchanges. That’s what MarketCore is. This is how we will build the Home for Global Markets.

DeFi Primitives

What we call DeFi Apps today, will be called DeFi Middleware tomorrow. What I mean by this is AMMs, Lending Markets, CDPs, Stablecoins and Vaults are financial infrastructure that power the apps of tomorrow. This opportunity is open to any builder, though we’ve onboarded some killer teams to play this important role in the RISE ecosystem.

The App Layer

The opportunity for Distribution and Modality innovation is massive, and we’re taking this seriously. Think of apps your grandma could use - that’s the target here. We finally have all the pieces in place to make this a reality. The DeFi infrastructure layer below provides everything needed to build a polished app for retail users in a matter of weeks, if not days.

And the headline act - all great chains start with one great app; RISEx is that app for RISE. The first Integrated Perps DEX, where CEX-grade perps and DeFi coexist, is composable with shared state. It’s the first instantiation of RISE MarketCore. This is the economic powerhouse that will bootstrap the RISE DeFi ecosystem. That’s all I’ll say today - more to come here. Pretty excited about this!

What’s next?

This was a lot. I’ll stop here. Expect more to come.

Mainnet is coming soon! For now, sign up to the RISEx waitlist at rise.trade and share your ref code with friends to increase your chance of getting closed beta access!

And together, let’s build The Home for Global Markets.