Programmable Markets: A Vision Ready for Reality - Why Now, Why RISE

Global markets are moving onchain. But infrastructure for programmable markets didn't exist. Until now. Here's RISE Vision.

The Vision: Global Markets, Actually Accessible

Imagine global financial markets where anyone, anywhere can trade any asset. No geographic gatekeeping. No institutional barriers. No waiting days for settlement or dealing with market hours. Just transparent, realtime orderbooks running onchain, where every transaction is verifiable and every participant starts on equal footing.

This isn't some distant future. The tech is here. The market proved it works. What's been missing is the infrastructure to make it real for everyone: orderbooks that perform like CEXs but compose with DeFi, wrapped in UX that feels like the modern web.

That's what we're building at RISE. Infrastructure that brings global exchange onchain to a transparent and realtime ledger. Infrastructure that anyone can build on.

Let me explain why this matters, what's been stopping it, and how we're solving it.

Why TradFi Is Fundamentally Broken

Traditional finance isn't just slow. It's broken by design, and the problems are becoming obvious.

The Inefficiency Problem

The inefficiency is built into the system. Settlement takes days when it should take seconds. Markets close for weekends and holidays when global demand runs 24/7. You can't access Binance perps in Australia, India, or the EU because of geographic licensing. Want to list a new asset? Regulatory barriers are nearly impossible to navigate without massive institutional backing. The system was built for the pre-internet era, and the problems are clear.

The Accessibility Problem

The inaccessibility is the point. Traders in dozens of countries are completely locked out. High net worth individuals seeking privacy get hit with invasive KYC requirements. Institutions drown in AML compliance and counterparty risk. Middle market participants can't access the same opportunities as the big players. No freedom to participate. No freedom to innovate.

The Infrastructure Gap

DeFi proved permissionless access works. AMMs showed anyone could provide liquidity and trade without gatekeepers. But serious trading stayed on CEXs because the infrastructure to run professional-grade orderbooks onchain just didn't exist.

Hyperliquid and Paradex proved fully onchain orderbooks work at scale. But they're applications, not infrastructure. RISE is building the composable orderbook infrastructure layer that any builder can use.

Three Things Standing in the Way

1. Orderbooks Couldn't Actually Perform Onchain

The technical reality was brutal. Orderbooks with latency over 10ms can't scale to meet global demand. Traditional blockchains couldn't deliver the throughput and speed pro trading requires. The UX was unusable. Traders got frontrun. Orders took seconds. Gas costs killed small trades.

Hyperliquid and Lighter proved fully onchain orderbooks are possible. That was the breakthrough. But making them work at scale while maintaining full composability with the EVM ecosystem requires a different technical approach.

That's what RISE is built for: orderbook infrastructure that performs AND composes.

2. Composability Didn't Exist

Here's the deeper issue: isolated orderbooks don't unlock real innovation.

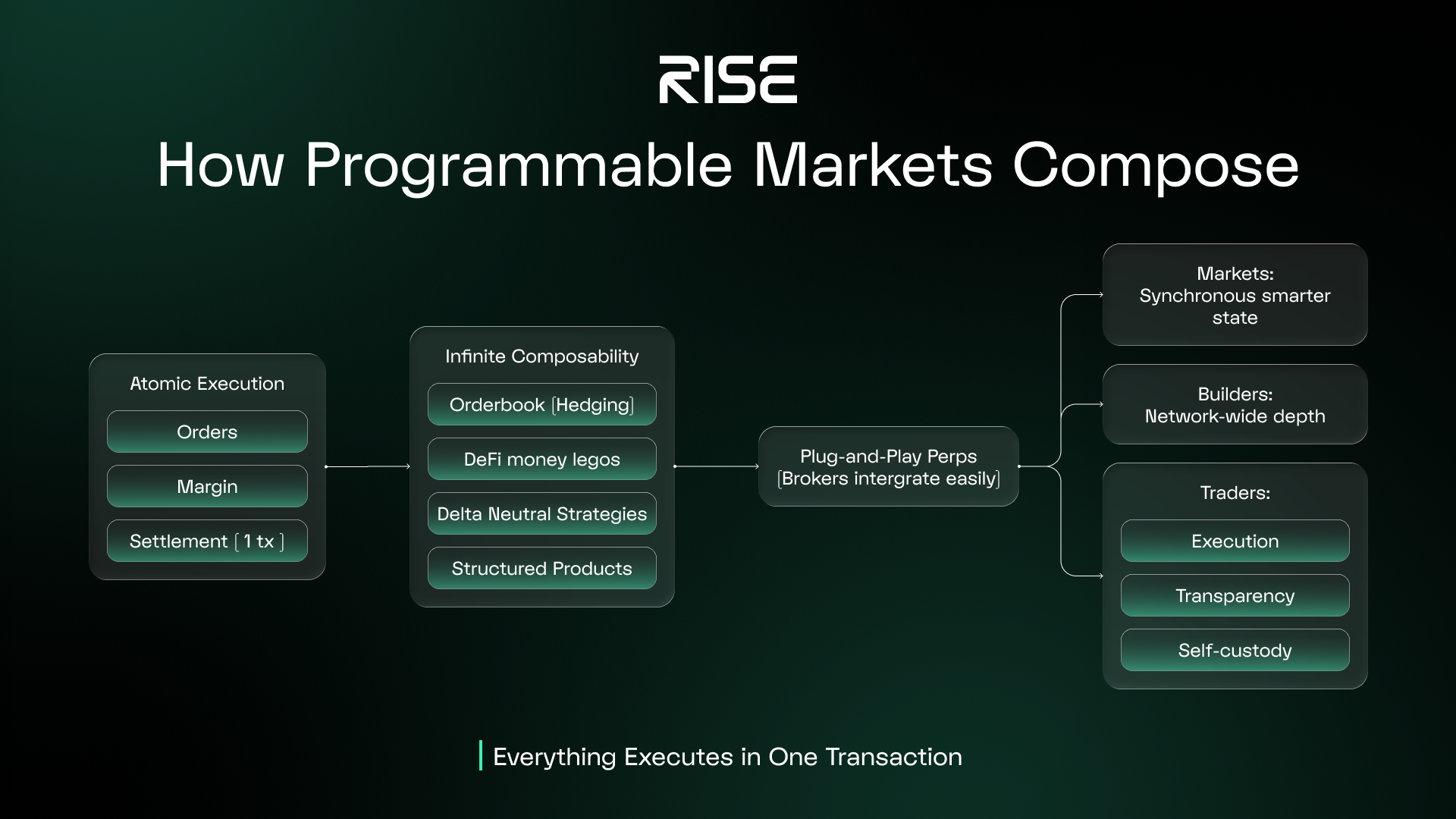

Think about what programmable markets actually need. Market makers need to hedge AMM inventory on the orderbook in the same transaction. Structured products need to source depth from shared books while routing the rest through AMMs. Brokers need to embed perps without building entire exchanges themselves.

None of this works unless orderbooks operate atomically (in the same transaction, guaranteed to execute together) with DeFi, sharing the same state (shared data and liquidity). If your orderbook lives in a separate execution environment, you've just rebuilt a silo. Liquidity can't flow between systems. Developers can't compose. The innovation can't happen.

3. UX Was Still Terrible

Even if you solved performance and composability, crypto UX scared mainstream users away. Complex wallet setup. Signing transactions constantly. Gas fees on every action. Multiple signatures just to do simple tasks.

Traders want one-click execution. Asset issuers want to list permissionlessly without managing gas for their users. Builders want to deliver web2 UX without compromising on decentralization. None of this was possible without fundamental UX infrastructure.

How We're Solving This

The EVM Layer is how we solved the performance problem. We rebuilt the entire EVM (Ethereum Virtual Machine) pipeline for continuous execution with Shreds. The result: 3ms execution latency live in testnet right now, with 100k TPS as the mainnet target. We extended the RPC to support realtime transactions (it's already live in Viem, Geth, and Alchemy), built realtime VRF, and optimized everything. We're leapfrogging Hyperliquid's tech with a generalized VM and shared state. Professional-grade performance, but inside the EVM everyone already knows how to build on.

RISE MarketCore is how we solved composability. This is orderbook infrastructure that anyone can build on, and it's what makes programmable markets real.

Building an orderbook exchange onchain is hard. Building it to work with the rest of DeFi is extremely challenging. You need a matching engine for perps in Solidity, a risk engine, a CEX-like API; and then need to somehow abstract and subsidize gas entirely. We've built all of this, and now we're opening it up.

Mobile app builders can plug into liquid books. Founders can list tokens permissionlessly. Asset issuers can launch their own markets. Any app can compose directly on shared books. AMMs, lending, vaults all integrate atomically with order flow. That's what programmable orderbooks means: exchange infrastructure every builder can freely compose on, with network-wide depth from day one.

RISE Wallet is how we solved UX. Gasless transactions, session tokens, social or passkey login. Developers ship faster. Users trade without the friction. The complexity disappears, but the decentralization stays.

It's Real, It's Live, and Teams Are Building

Our testnet is live right now with 3ms latency. We've processed nearly 4 billion transactions from 3.7 million addresses, and we're targeting 100k TPS for mainnet.

RISEx, our flagship Integrated Perps DEX, runs in a sub-3ms finality environment with CEX-like APIs, sponsored gas, and streaming orderbook snapshots. We acquired BSX Labs, a team with real orderbook volume and advanced trading engine experience, to accelerate this. Teams are already lining up to build on RISE MarketCore.

Here's what's important to understand: RISE is infrastructure at its core. We're not building the DeFi primitives, the AMMs, the lending protocols, or the vaults. That's open to any builder. RISEx exists to prove the infrastructure works and bootstrap the ecosystem, but the real opportunity is what everyone else will build on top.

Join Us

RISE is building the Home for Global Markets. If you believe better markets should be transparent, accessible, and onchain, there's a spot for you.

Traders: Want to see what the future of finance looks like? Sign up to the RISEx waitlist at rise.trade for closed beta access.

Builders: Want to capture this opportunity and build fintech products on composable orderbooks? Get in touch. We're onboarding teams now.

Asset issuers: Want deep, permissionless liquidity for your assets on transparent markets? Contact us.

The vision is clear. The infrastructure is ready. The timing is now.

Let's build it together.